maryland ev tax credit form

A refund if the bill has already been paid. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

What Electric Vehicle Rebates Can I Get Rategenius

Please mail completed form to.

. Go to the MVA website for the current status of the Maryland EV Tax Credit program and do your due diligence before making a purchase. If you have questions regarding submitted applications andor their status please contact evsemeamarylandgov. HB1391 extends the expiring EV tax credit of 3000 when you purchase an EV but reduces eligibility by lowering the maximum cost of the vehicle from 63000 to 55000.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Maryland excise tax credit not reauthorized for fy 2021. Mail all paperwork to.

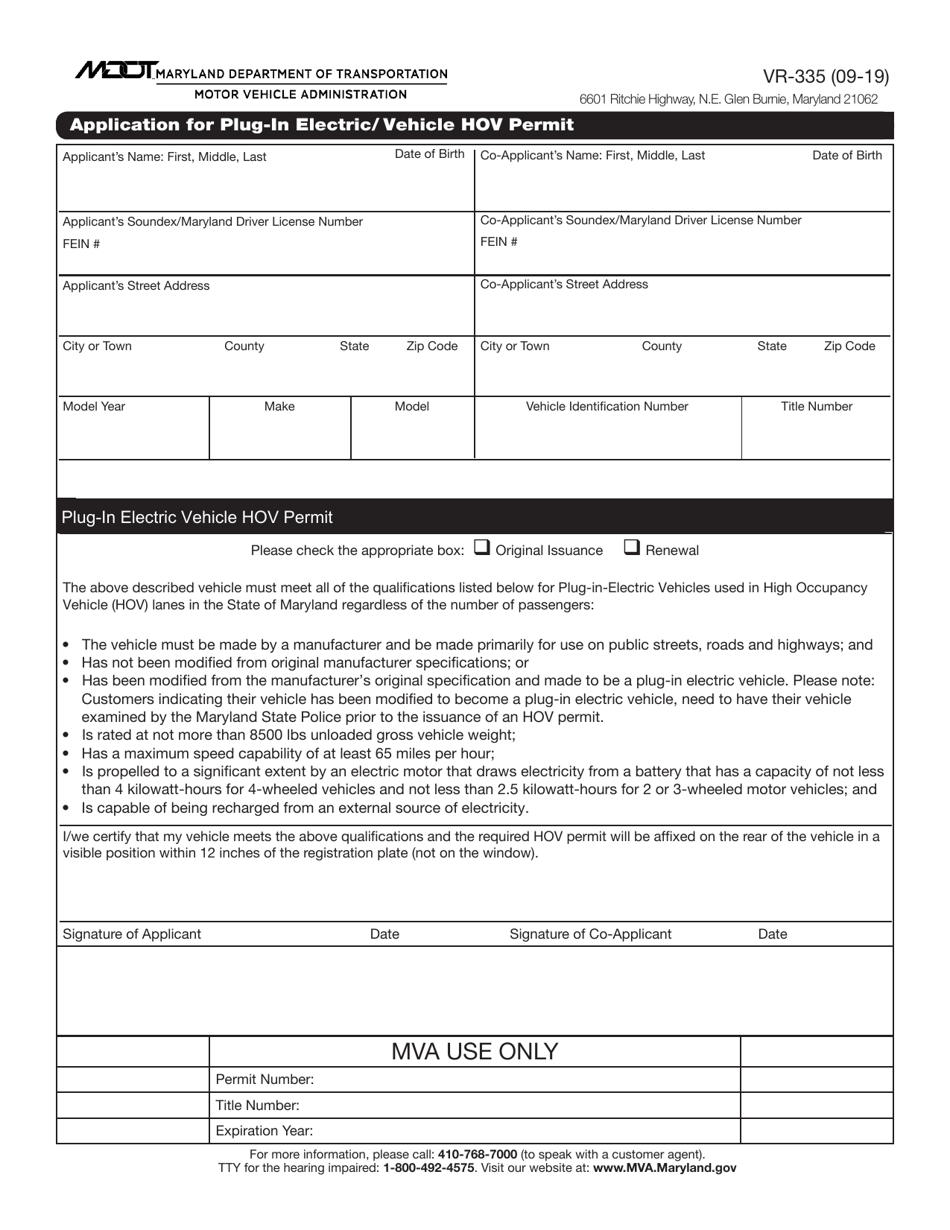

For more general program information contact MEA by email at michaeljones1marylandgov or by phone at 410-598-2090 to speak with Mike Jones MEA Transportation Program Manager. Credit directly on the July property tax bill if the application is completed properly and is not subjected to audit and is received before April 15 2022. If you have purchased a plug-in electric or fuel cell electric vehicle from a Maryland dealer the dealer will assist you with completing the proper form for the tax credit you may download t he Excise Tax Request for a Plug-in Electric Vehicle or Fuel Cell Electric Vehicle VR-334 form.

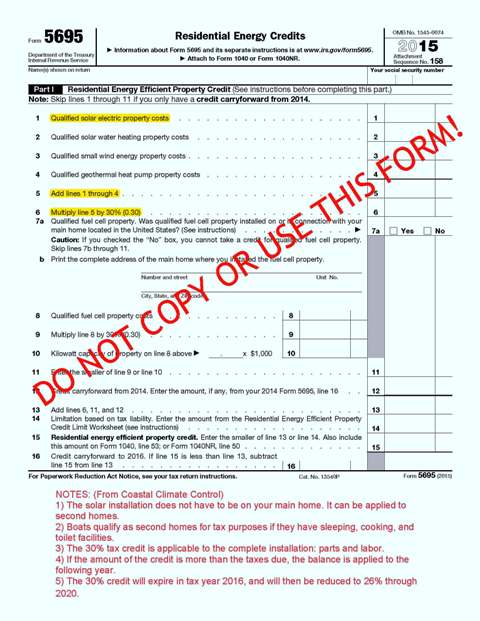

Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and this amount can be up to 7500. Through the programs below MEA helps Maryland residents businesses non-profits and local governments implement energy efficiency upgrades and. For model year 2021 the credit for some vehicles are as follows.

Will There Be New Federal Electric Vehicle EV Tax Expansions. Tax credits depend on the size of the vehicle and the capacity of its battery. Written denial stating the reason for ineligibility.

Gather any required documentation mentioned in the application. Projects must take place in the. Federal Credits The best place to start is by understanding what types of credits are available.

FORMS WEB TEAM Subject. The credit ranges from 2500 to 7500. By submitting this application the applicant will receive one of the following.

The Clean Cars Act of 2017 signed into law by Governor Larry Hogan authorized an excise tax. Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

First and foremost Maryland residents can take advantage of the Federal Income Tax Credit for qualified EVs and PHEVs. You must also report the credit on Maryland Form 502 505 or 515. Be a resident of Maryland Drive an EV Have purchased and installed a qualifying level 2 charger after July 1 2019 Be a customer of the utility whose rebate you are applying for Fill out the application found on the utility website look for PIV Managed Charger Program or residential rebate.

Governor Mary Beth Tung Director Please Fill Out Form Electronically Print Sign and Return to MEA. The maryland energy storage income tax credit must be reported on form 500cr. Posting as a PSA to Marylanders on this thread.

To receive your 300 rebate you must. The Maryland Electric Vehicle Tax Credit. Utah food tax increase 2020.

For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and. To claim the credit you must complete Part K of Form 502CR and attach to your Maryland income tax return. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

Hogan Jr Governor Boyd K. Of tax Form 502 or Form 505. Maryland Motor Vehicle Administration Excise Tax Refund Unit.

Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Download and complete EVSE Form A. Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future.

Maryland Department of Housing and Community Development 7800 Harkins Road Lanham Md. However you should still submit the form to reserve your place in line in case funding is approved in the future. Maryland ev tax credit form Friday March 18 2022 Edit.

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. The Maryland Energy Administration manages grants loans rebates and tax incentives designed to help attain Marylands goals in energy reduction. Comptroller of Maryland Payment Processing PO Box 8888 Annapolis MD 21401-8888 COMRAD-006 MARYLAND FORM PV PERSONAL TAX PAYMENT VOUCHER FOR FORM 502505 ESTIMATED TAX AND EXTENSIONS INSTRUCTIONS.

All Required Fields on this Form Must be Filled Out Completely. There is no fee for applying for the tax credit. Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies local and county.

For more information contact. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle. Taxa outdoors cricket camper review.

Maryland ev tax credit form Monday March 7 2022 The state offers a one-time tax credit of 100 per kilowatt-hour of battery capacity up to a maximum of 3000. Credit limited to the acquisition of one electric vehicle per individual and 10 per business entity. 1500 tax credit for each plug-in hybrid electric vehicle purchased Battery capacity must be at least 50 kilowatt-hours Eligible purchase price on plug-in fuel cell vehicles raised from 63000 to 73000.

1800 Washington Blvd Suite 755. Maryland Excise Tax Credit The Maryland excise tax credit expired on June 30 2020 but could be funded in the future. Excise Tax Credit Request For Plug-In Electric or Fuel Cell Vehicle VR-334 07-21.

Maryland citizens and businesses that purchase or lease these vehicles. 18 million per FY for rebates for Electric Vehicle Service Equipment EVSE. 2006 Honda Civic Fd K20 2 0 Full Car Review.

Download and complete the appropriate Initial Credit Certificate application for residents or businesses. This means if your vehicle exceeds 55000 you will get nothing back on the 6 you pay the State for purchasing your vehicle. This program essentially acts as a rebate for the purchase of a new qualified car to the tune of 30 of the cars sale price or 7500.

Act fast however this credit will be phasing out over the next few years.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Ochp Ochp Md At Master E Clearing Net Ochp Github

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Form Vr 335 Download Fillable Pdf Or Fill Online Application For Plug In Electric Vehicle Hov Permit Maryland Templateroller

Maryland Energy Administration

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech