tax strategies for high income earners canada

When personal income exceeds 200000 in. The loan is made at the cras prescribed interest rate.

High Income Earners Need Specialized Advice Investment Executive

Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

. High-income earners make 170050 per year. Learn How EY Can Help. We will begin by looking at the tax laws applicable to high-income earners.

Make The World Your Marketplace With Aprios Intl Tax Planning Services. This tax reduction strategies for high income earners canada pdf can be taken as competently as picked to act. Starting Oct 16th 2017 the Federal Government declared they were reducing small business.

Registered Retirement Savings Plans RRSPs Registered Education Savings Plans. How to Pay Less Tax in Canada 12. A Solo 401k for your business delivers major opportunities for huge tax.

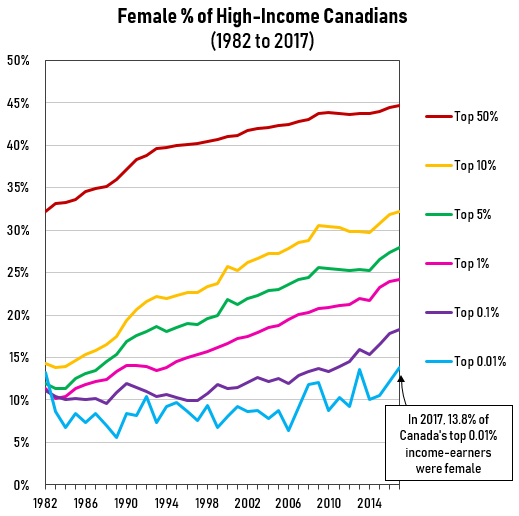

Ad Helping Businesses Navigate Various International Tax Issues. Fiscal Policy and Income Inequality International Monetary Fund 2014-07-03 Can. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Contact a Fidelity Advisor. Tax Saving Strategies for High-Income Earners. Ad Helping Businesses Navigate Various International Tax Issues.

This article highlights a non-exhaustive list of tax. Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the. Contact a Fidelity Advisor.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Ad Access tax-forward insights tools strategies for maximizing after-tax return potential. Tax Guide for Seniors - Publication 554 For.

Clients In 50 Countries. Tax Tips For High Income Earners Canada. Its possible that you could.

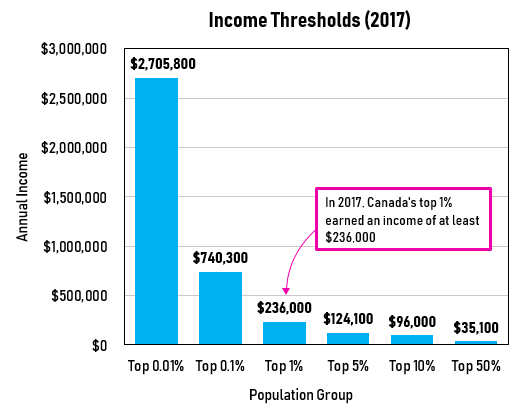

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Max Out Your Retirement Account.

Publication Tax Reduction Strategies For High Income Earners Canada as without difficulty as review them wherever you are now. An overview of the tax rules for high-income earners. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. At Eaton Vance we think about taxes year round so you can focus on what matters most.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Ad Cross New Borders With Confidence. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

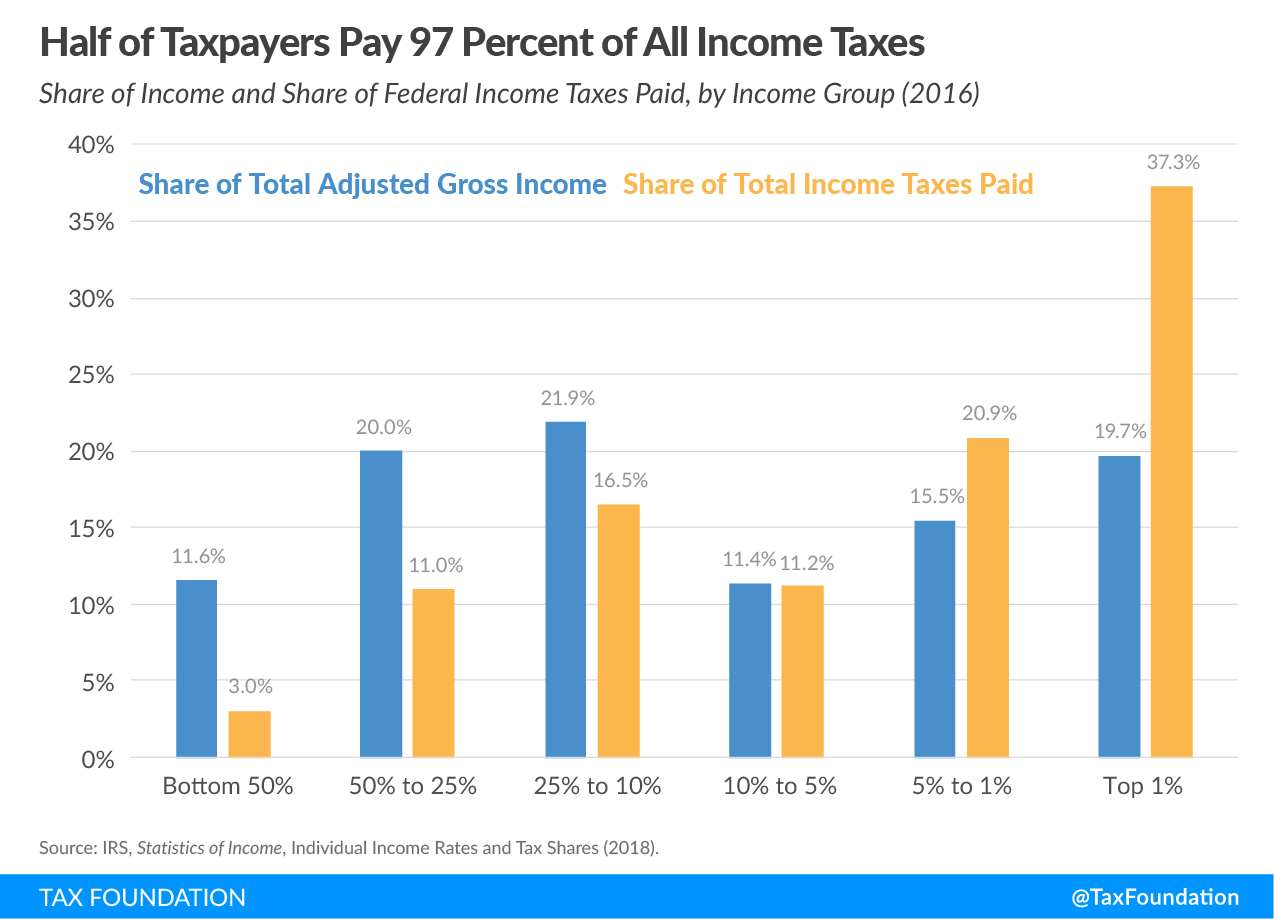

Here are some of our favorite income tax reduction strategies for high earners. For high income earners and high-net-worth families taxes can pose a significant impediment to preserving and growing wealth particularly in cases where income or wealth is. Learn How EY Can Help.

Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Tax rates in canada for 2022. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

How To Reduce Taxes For High Income Earners In Canada

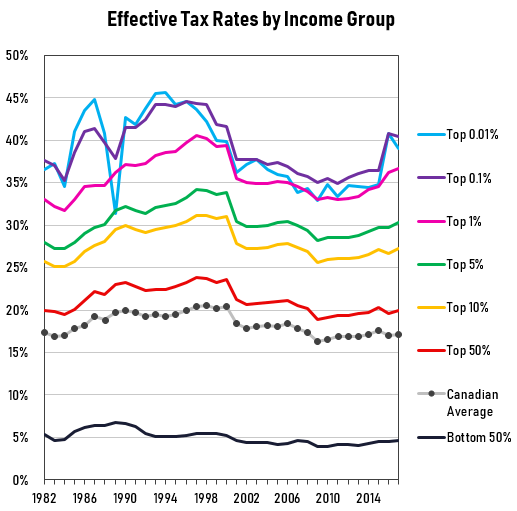

Millionaires And High Income Earners Tax Foundation

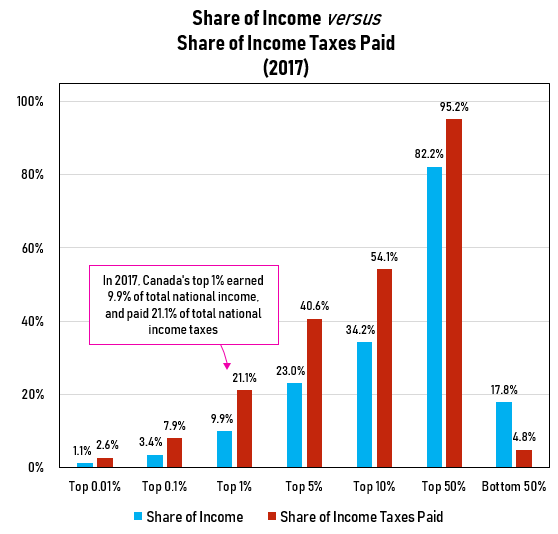

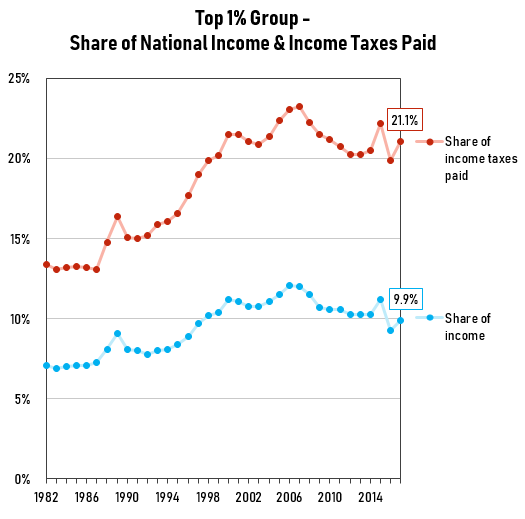

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

Proposed Tax Changes For High Income Individuals Ey Us

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Tax Planning For High Income Canadians Mnp

Millionaires And High Income Earners Tax Foundation

Pin On Stuff Worth Reading And Knowing

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

Tax Strategies For High Income Earners 2022 Youtube

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube